33+ Florida Car Tax Calculator

Customize using your filing status deductions. You will need to.

How To Calculate Florida Sales Tax On A Motor Vehicle Purchase Budgeting Money The Nest

Calculations based off of the Fee Calculator PDF developed by John Archer in partnership with the Hillsborough County Tax.

. Web An out-of-state dealer who does not have a Florida sales tax number buys a motor vehicle for resale or lease. An entity holding a current Florida Consumers Certificate. Web You pay 1680 in-state sales tax 6 of 28000.

On top of that depending on which. Find out how much youll pay in Florida state income taxes given your annual income. Web The amount of Florida sales tax to be collected is the amount of sales tax that would be imposed by the purchasers home state if the vehicle were purchased in that state.

Web Buying a car costs more than just the sticker price. Web Florida car tax is 251094 at 600 based on an amount of 41849. Web Calculations based off of the Fee Calculator PDF developed by John Archer in partnership with the Hillsborough County Tax Collector Office.

Web Multiply the sales price of the vehicle by the current sales tax rate. Enter your info to see your take home pay. The statewide rate for used car sales tax in the state of Florida is 6 of the vehicles purchase price.

Calculating County Discretionary Sales Surtaxes. Tax is calculated on the sales price of a new or used motor vehicle less credit for trade-in when sold through a. For example if youre a Florida resident buying a vehicle with a total sale price of 18252 your sales tax is.

When purchasing a vehicle the tax and tag fees are calculated based on a number of. This taxable value is combined from the sale price of 39750 plus the doc fee of 799 plus the extended. Web Florida Sales Tax Discretionary County.

Web To calculate the sales tax for a car purchase in Florida one needs to add the statewide sales tax rate which is 6 and the discretionary sales surtax which varies by county. Web Florida vehicle sales tax calculator. In addition to the states 6 sales tax rate Florida law.

Web Please reload the page. Before-tax price sale tax rate and final or after-tax price. Web SmartAssets Florida paycheck calculator shows your hourly and salary income after federal state and local taxes.

Web A state tax rate of 6 applies to all car sales in Florida but your total tax rate will vary based on county and local taxes which can be anywhere from 0 to 15. Web The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Find Your States Vehicle Tax Tag Fees.

Web Enter Your VIN. Use an online vehicle tax and tags calculator to estimate additional costs that come with buying a car. Get Your CARFAX Report.

Web While there is no easy to use Florida car tax calculator the following method will show you how to get a good ball park amount for taxes you will have to pay. Web You can calculate the car tax on your vehicle in Florida by using the online car tax calculator provided by the Florida Department of Revenue.

What Is The Tracking Lottery Strategy Quora

What Made You Buy Your 3rd Gen Third Generation F Body Message Boards

Pdf Semantic Relatedness In Dbpedia A Comparative And Experimental Assessment

Which Countries Make The Most Cars Per Capita Outside Of Europe And North America Quora

Sales Tax On Cars And Vehicles In Florida

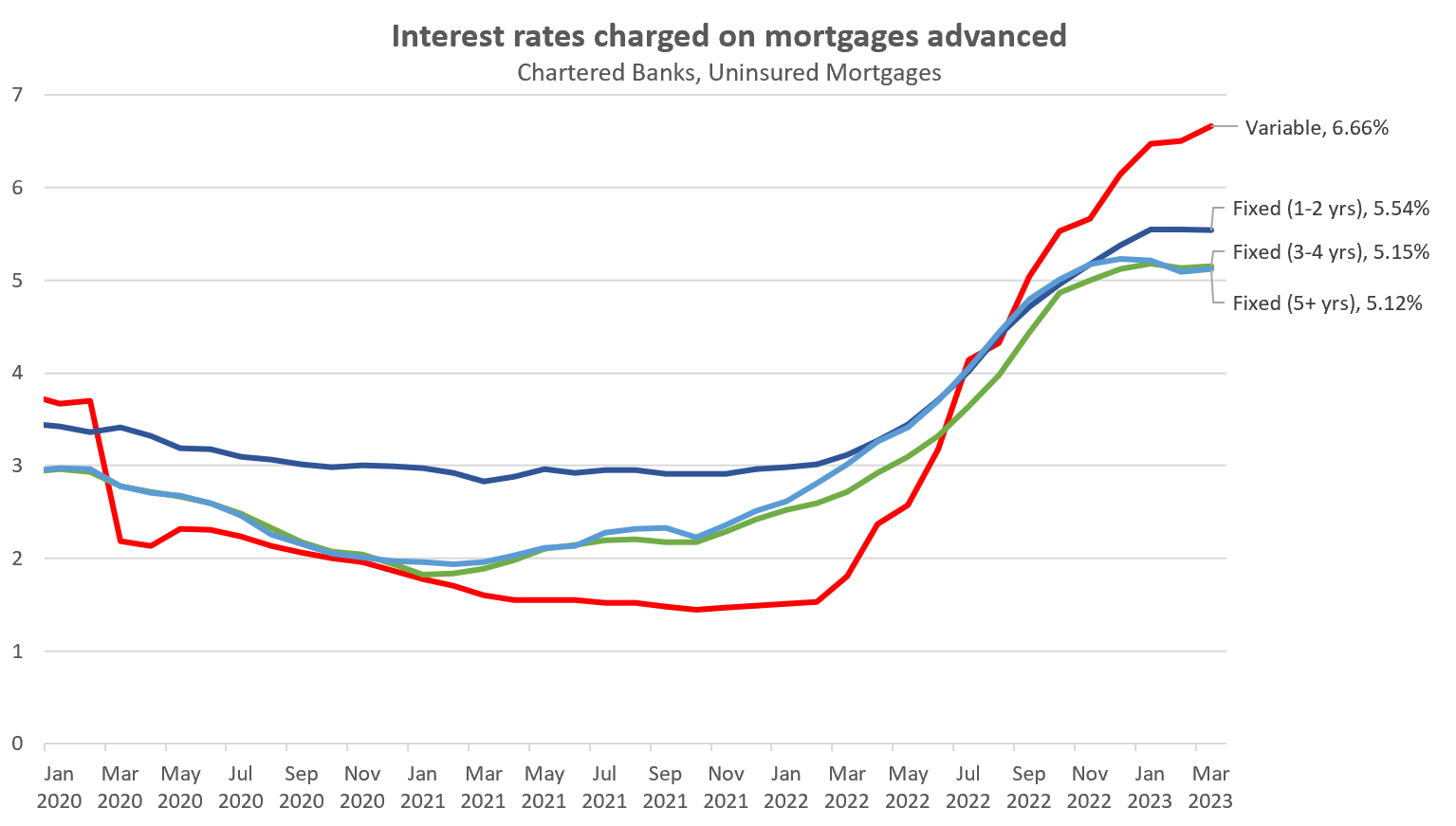

A Mix Of Good And Bad Indicators On Debt House Hunt Victoria

What Made You Buy Your 3rd Gen Third Generation F Body Message Boards

Ogrx 2 Source Data Papers Json At Master Govlab Ogrx 2 Github

2000 Towerside Ter 802 Miami Fl 33138 Mls A11389338 Redfin

Florida Vehicle Sales Tax Fees Calculator

Florida Vehicle Sales Tax Fees Calculator

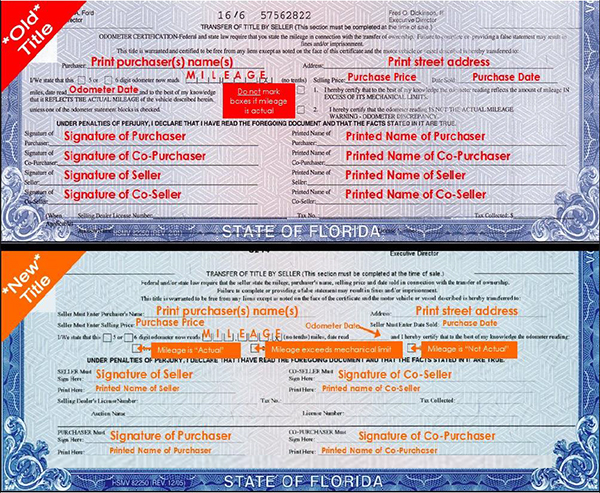

Purchase From Individual Sarasota Tax Collector

Careers Employability Handbook By Doddlecareers Issuu

Calameo Florida May 2018

Pgs506coursenotes 3 Wordpress Www Wordpress Com

5008 Longmeadow Park Street Orlando Fl 32811 Mls O6138145 Flmfr

4908 38th Way S 501 Saint Petersburg Fl 33711 Mls U8216714 Flmfr